Credit Passport®

Extend Credit to a World of New Customers

Each year, two million newcomers to the U.S. and over 280 million newcomers worldwide have to abandon credit history that's locked in their home country. Credit Passport® opens access to international consumer-permissioned credit data from 2.8bn individuals to help lenders serve this segment, building loyal customers for life.

Trusted By:

How Credit Passport® Works

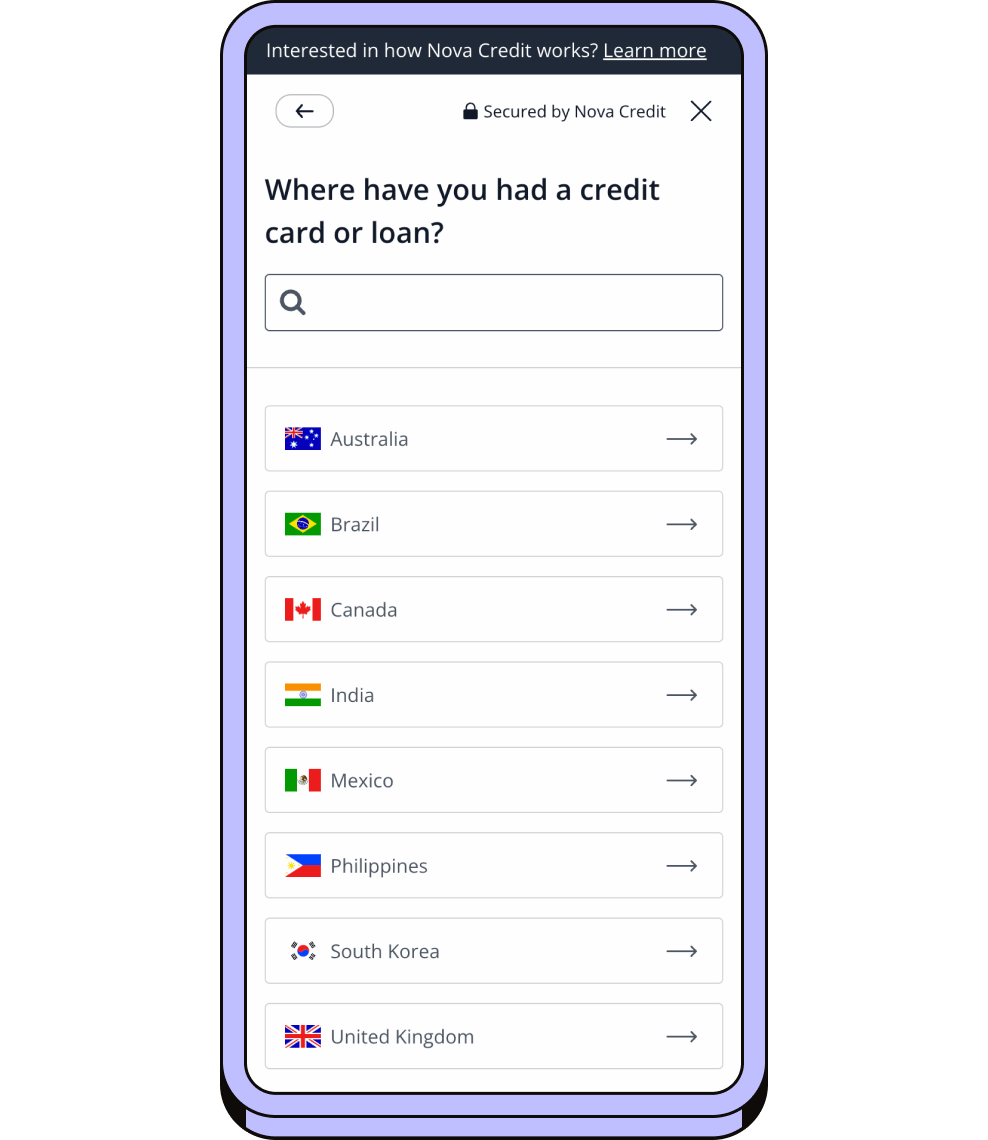

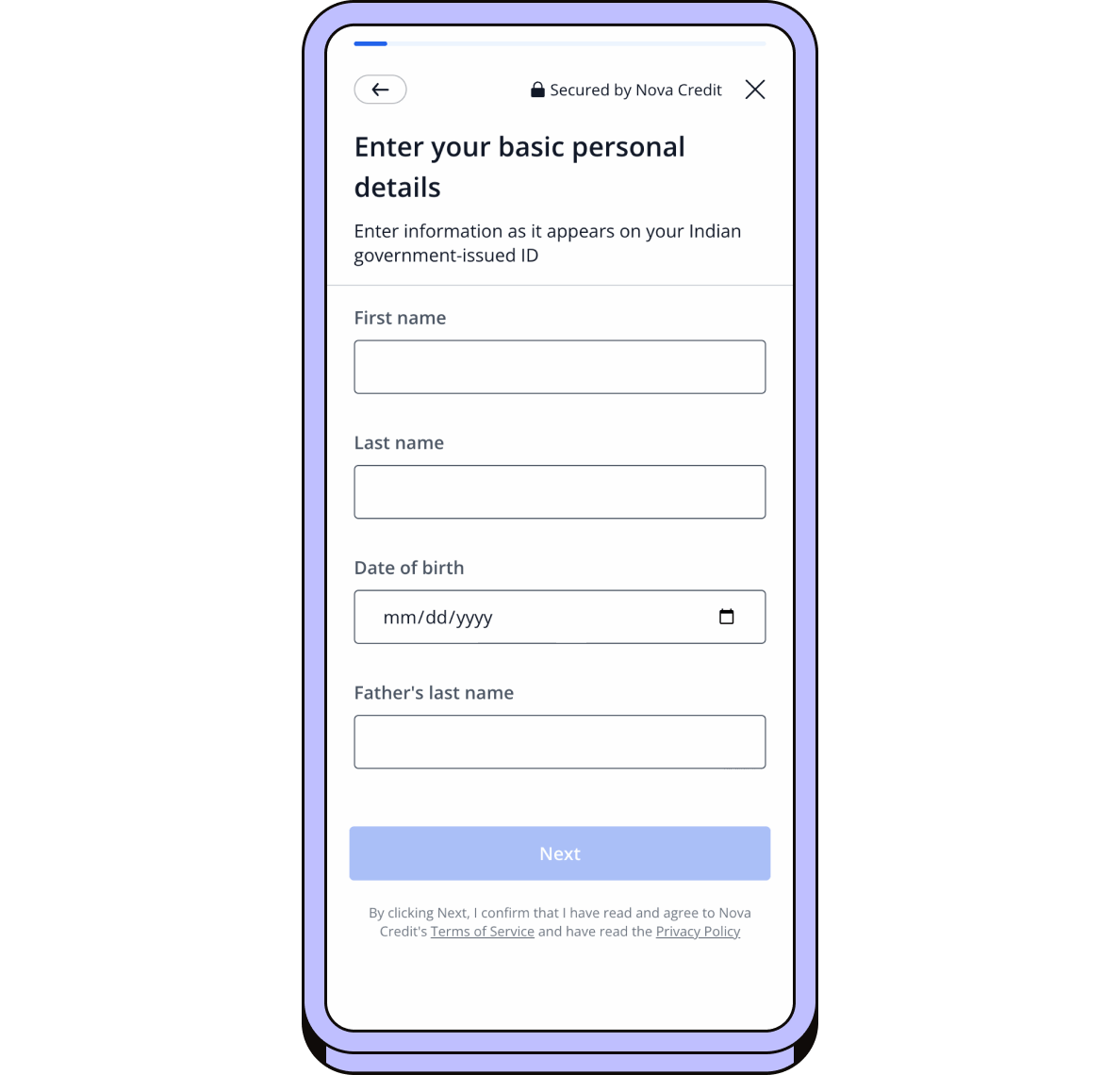

With a few simple steps, we can instantaneously translate an international credit report into an local-equivalent credit score, tradelines, risk attributes, and other common measurements. Create a fully branded API experience for your customers.

The creditseeker follows the country-specific instructions to grant access to their international credit data.

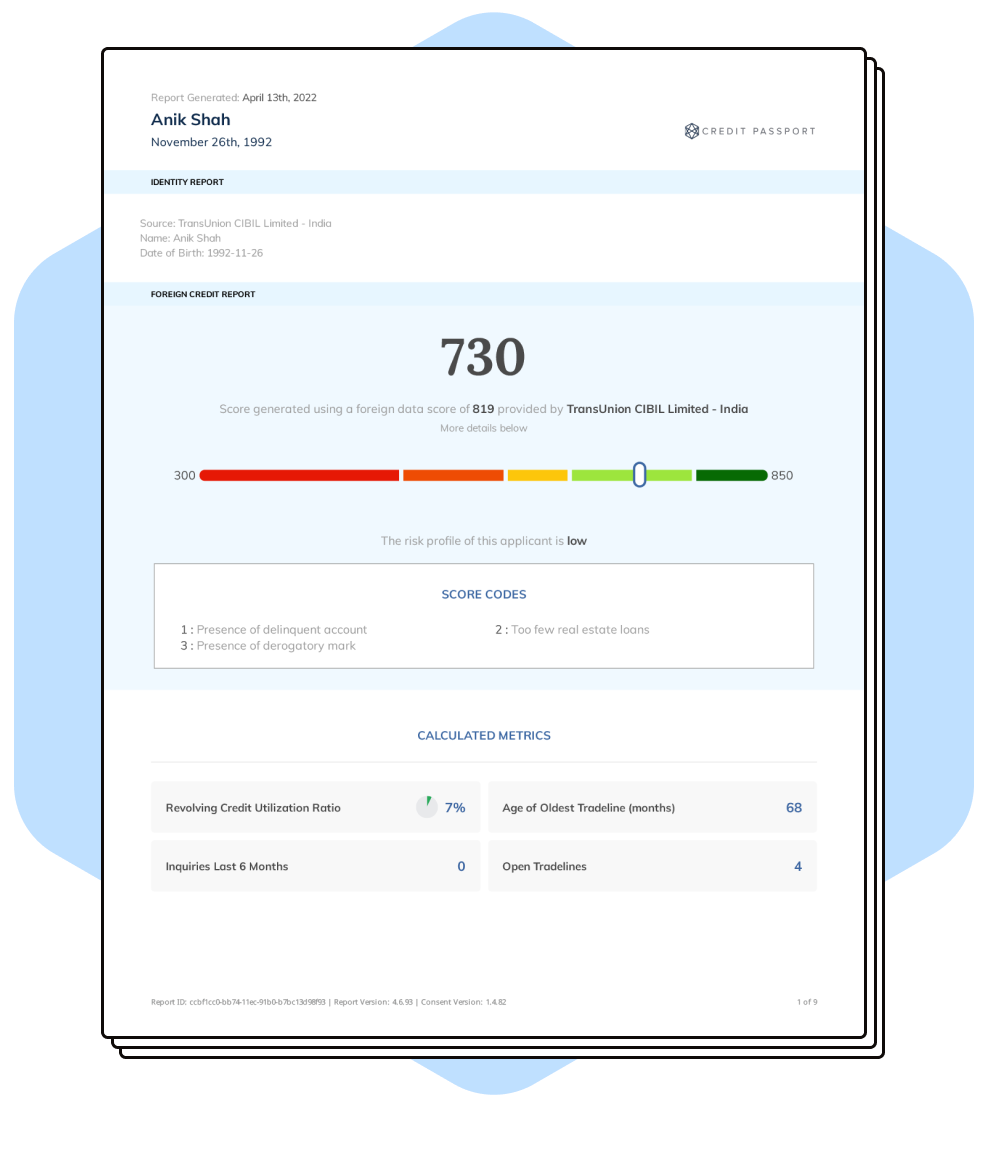

After authentication, we send the data to you and to the customer simultaneously, in a standardized format.

Credit Passport® makes decisioning easy with a local equivalent credit score and other metrics that are familiar to lenders.

Why Credit Passport®

Increase Originations Profitability With Confidence

Nearly 100% of population growth in developed countries is driven by immigration. The newcomer segment presents a better risk profile on average vs. domestic populations.

Improve Risk Assessment for International Arrivals

International credit data translated to a local equivalent format helps lenders assess credit risk for consumers with little to no local credit history.

Build Brand Loyalty Through Financial Inclusion

Addressing a consumer segment that’s underserved by financial products and services helps build brand equity over the long term.

A Multi-Industry Solution

We empower banks, credit unions, and lenders to make more informed financial decisions.

Learn more about our Solutions by Industry and Solutions by Use Case

Financial Institutions

Banks, credit unions, and fintech companies can offer competitive terms on credit cards, installment loans, and more.

Tenant Screening

Property managers can run credit checks on non-citizens to minimize risk and improve the tenant screening process.

Auto Loans

Direct and indirect loan companies can extend the reach of auto financing.

Telecommunications

Communications companies can offer more post-paid telecom plans and services.

Student Loans

Assist high credit-value students and future residents with building their financial future.

Mortgage

Enable newcomers to access housing and property with the help of Credit Passport.

Credit Passport® Reports

We standardize international credit data into formats that are recognizable to domestic underwriters:

Local equivalent credit score

Tradelines and payment history

Credit-seeking inquiries

Aggregate risk attributes

Newcomer KYC

FCRA consumer report with adverse action codes and dispute resolution management

Global Supply Relationships

Our integrations with international credit bureaus enable access to up to 2.8 billion credit records in more than 20 countries. Among our partners:

How to Get Started

Simple

Dashboard

A UI for lenders to send invites to consumers to provide their foreign credit report.

Integrated

Connect

A conversion-optimized module embedded seamlessly in digital applications

Custom

API

An endpoint to build custom consumer-permissioning modules

Resources & Insights

Let’s Grow Your Business Together

Submit your information and a member of our team will be in touch. about how we can grow your business together.